Lucky Block (LBLOCK) entered the cryptocurrency scene with a bang, promising a revolutionary decentralized lottery system that could potentially transform the gaming industry. Initially, the project’s innovative concept and aggressive marketing efforts fueled a surge in its token value, captivating the attention of investors and enthusiasts alike. However, as the initial excitement waned, a dramatic decline in LBLOCK’s value has cast doubt on the project’s legitimacy and long-term viability. In this article, we delve into the rise and fall of Lucky Block, examining the hype and the red flags that have emerged along the way.

The Rise and Fall of Lucky Block

When Lucky Block launched, it quickly garnered attention due to its unique proposition of creating a decentralized lottery system powered by blockchain technology. The promise was to offer a fairer, more transparent, and efficient lottery experience compared to traditional systems. This concept, coupled with strategic marketing, led to a rapid increase in LBLOCK’s token value. Investors were enticed by the potential of high returns and the novelty of the project, resulting in a significant influx of capital.

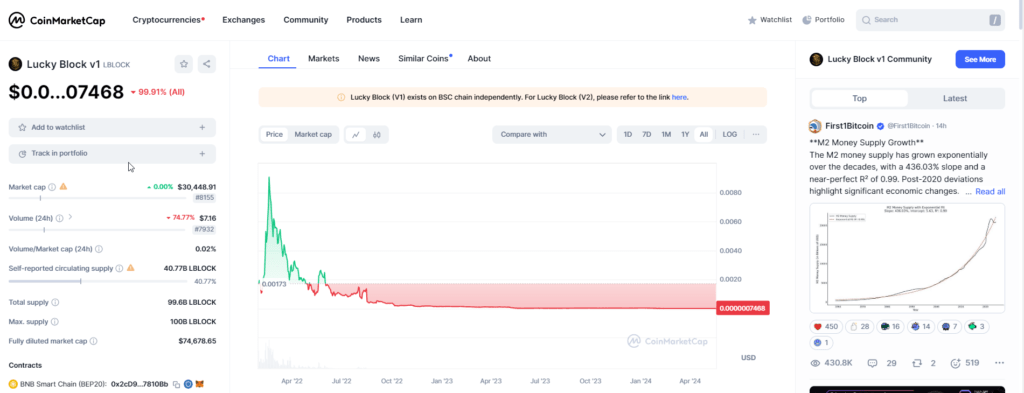

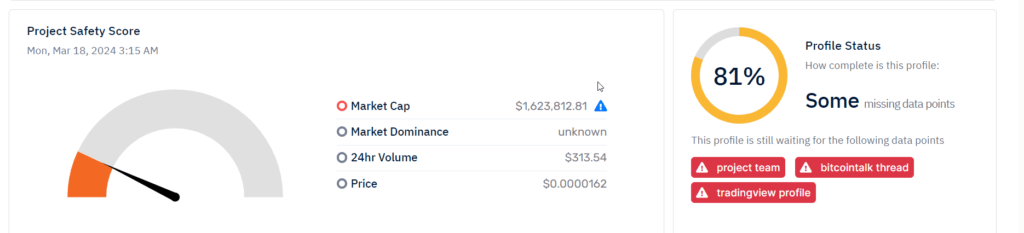

However, the meteoric rise was followed by an equally dramatic fall. As the initial hype subsided, several concerns began to surface. One of the primary issues was the lack of listing on major cryptocurrency exchanges. This limited the token’s accessibility and liquidity, raising questions about the project’s credibility. Additionally, the project’s white paper, which serves as a critical document outlining the technical and strategic details of the venture, was found to be lacking in comprehensive technical information. This omission raised suspicions about the feasibility and legitimacy of the project.

Moreover, scrutiny of the team behind Lucky Block revealed unsettling associations with previous ventures that had questionable reputations. This further fueled skepticism among investors and industry observers. As these red flags accumulated, the token’s value plummeted, leaving many early investors at a loss.

Red Flags to Consider

The story of Lucky Block is a reminder of the potential pitfalls in the cryptocurrency market. Here are some of the key red flags that emerged in the case of LBLOCK:

Missing Transparency

One of the most significant concerns with Lucky Block was the lack of transparency. A comprehensive and detailed white paper is essential for any cryptocurrency project as it provides crucial insights into the technical framework, roadmap, and objectives. In the case of Lucky Block, the white paper was notably vague, lacking detailed explanations of the underlying technology and operational mechanics. This opacity made it difficult for investors to assess the project’s viability and trustworthiness.

Unrealistic Gains

The steep price increase in LBLOCK’s early days was another red flag. While rapid gains can sometimes be a sign of a strong project gaining deserved recognition, they can also indicate market manipulation or speculative frenzy. Projects that promise or exhibit unrealistic returns in a short period should be approached with caution, as they often attract hype-driven investments that can lead to severe volatility and subsequent losses.

Listing on Unknown Exchanges

The fact that LBLOCK was not listed on major, reputable exchanges was a significant drawback. Instead, it was primarily available on lesser-known platforms, which typically lack the regulatory oversight and security measures of more established exchanges. This limitation not only hindered the token’s liquidity and market reach but also raised concerns about the project’s legitimacy and the safety of investor funds.

Negative Reviews and Community Sentiment

The cryptocurrency community is a valuable source of information and sentiment. In the case of Lucky Block, numerous negative reviews and warnings emerged on online forums and social media platforms. Many experienced investors and analysts highlighted the project’s shortcomings and advised caution. Paying attention to the community’s sentiment can provide early warnings about potential issues with a project.

Tips for Your Crypto Journey

The story of Lucky Block underscores the importance of due diligence and caution in the volatile world of cryptocurrency. Here are some tips to help you navigate your crypto investment journey more safely:

Do Your Own Research (DYOR)

Never invest blindly based on hype or recommendations from others. Thoroughly research any project you consider investing in. This includes reading the white paper, understanding the team’s background and experience, and evaluating the project’s roadmap and objectives. Look for comprehensive technical details and a clear explanation of how the project intends to achieve its goals.

Invest What You Can Afford to Lose

The cryptocurrency market is notoriously volatile, with prices capable of significant fluctuations in short periods. It’s crucial to only invest amounts you are comfortable potentially losing. This approach helps mitigate the financial impact of adverse market movements and allows for a more measured investment strategy.

Beware of Hype

Projects with aggressive marketing campaigns and promises of unrealistic returns should be approached with skepticism. Hype can drive short-term price increases, but it often lacks the substance needed for long-term success. Focus on projects with solid fundamentals, realistic goals, and transparent communication.

Stick to Reputable Exchanges

Use established and secure platforms for your cryptocurrency transactions. Reputable exchanges offer better security, regulatory oversight, and liquidity. They also tend to list projects that have undergone more rigorous vetting processes, reducing the risk of scams or poorly managed ventures.

A Deeper Dive into Lucky Block’s Mechanisms and Promises

To fully understand the rise and fall of Lucky Block, it’s important to examine the project’s mechanisms and promises in greater detail. Lucky Block aimed to disrupt the traditional lottery industry by leveraging blockchain technology to create a decentralized and transparent lottery system. This approach promised several advantages over conventional lotteries, including:

Enhanced Transparency

Traditional lottery systems often operate with limited transparency, leading to mistrust among participants. Lucky Block proposed a decentralized system where all transactions and results would be recorded on the blockchain, ensuring complete transparency and verifiability. This feature was intended to build trust among users and provide a more equitable gaming experience.

Fairness and Security

The use of smart contracts was another key component of Lucky Block’s proposition. Smart contracts are self-executing contracts with the terms of the agreement directly written into code. They automatically enforce and execute the contract’s terms when predefined conditions are met. By utilizing smart contracts, Lucky Block aimed to eliminate the possibility of manipulation or tampering with lottery results, ensuring a fair and secure system for all participants.

Global Accessibility

Lucky Block also aimed to offer a more inclusive and accessible lottery system. Traditional lotteries are often restricted by geographical boundaries and regulatory frameworks. In contrast, a decentralized lottery system on the blockchain could potentially be accessed by anyone with an internet connection, opening up participation to a global audience. This increased accessibility was seen as a significant advantage, allowing more people to engage with the platform.

The Marketing Blitz

To promote these features, Lucky Block embarked on an aggressive marketing campaign. The project leveraged social media, influencer endorsements, and community engagement to generate buzz and attract investors. This strategy initially paid off, with LBLOCK tokens experiencing a rapid surge in value. The promise of revolutionizing the lottery industry, combined with the allure of high returns, drew significant attention and investment.

The Cracks Begin to Show

Despite the initial success, cracks soon began to appear in Lucky Block’s facade. As the excitement of the launch faded, more critical eyes began to scrutinize the project’s fundamentals. The lack of detailed technical explanations in the white paper became a major point of contention. Investors struggled to understand the intricacies of the system, and the absence of comprehensive information raised doubts about the project’s viability.

Moreover, the team’s background came under scrutiny. Research revealed that some team members had associations with previous ventures that had raised red flags in the past. This connection further eroded trust and fueled suspicions about the project’s intentions and management.

The Downward Spiral

As skepticism grew, the token’s value began to decline. Investors who had bought into the initial hype started to sell off their holdings, exacerbating the downward trend. The limited availability of LBLOCK on major exchanges compounded the problem, as it restricted liquidity and made it difficult for investors to exit their positions. This lack of liquidity further accelerated the decline in token value.

Community sentiment also played a significant role in the project’s downturn. Negative reviews and warnings from experienced investors spread across online forums and social media platforms. The growing chorus of concerns made it increasingly difficult for Lucky Block to attract new investors or retain existing ones.

Lessons Learned from Lucky Block

The story of Lucky Block offers several valuable lessons for cryptocurrency investors:

Importance of Due Diligence

Thorough research and due diligence are crucial when evaluating any cryptocurrency project. This includes scrutinizing the white paper, assessing the team’s background, and understanding the project’s technical and strategic details. Investors should look for clear, detailed information that demonstrates the project’s feasibility and potential.

The Risks of Hype-Driven Investments

Hype and aggressive marketing can drive short-term gains, but they often lack the substance needed for long-term success. Projects that promise unrealistic returns should be approached with caution. It’s important to focus on fundamentals and avoid getting swept up in the excitement.

The Need for Transparency and Trust

Transparency and trust are essential components of any successful cryptocurrency project. Investors should prioritize projects that provide clear, verifiable information and demonstrate a commitment to transparency. A detailed white paper, a reputable team, and transparent communication are key indicators of a trustworthy project.

The Role of Community Sentiment

Community sentiment can provide valuable insights into a project’s potential. Negative reviews and warnings from experienced investors should not be ignored. Eng

aging with the community and paying attention to collective sentiment can offer early warnings about potential issues. Participating in forums, reading reviews, and following discussions on social media can help investors gauge the broader perception of a project and make more informed decisions.

The Aftermath: What Happened to Lucky Block?

After the significant decline in token value and the mounting skepticism, the future of Lucky Block became uncertain. While some early adopters may have exited with profits, many were left holding devalued tokens. The project’s credibility was severely damaged, making it difficult to regain investor trust and market traction.

Despite these setbacks, there were efforts within the community and from the project team to address some of the criticisms. These efforts included:

Attempts to Improve Transparency

In response to the criticism about the lack of detailed information, the team behind Lucky Block started to provide more comprehensive updates and explanations. They released additional documentation and engaged more actively with the community to answer questions and address concerns. However, these efforts often came too late to reverse the negative sentiment that had already taken hold.

Seeking Major Exchange Listings

To improve liquidity and accessibility, there were attempts to list LBLOCK on more reputable and widely-used cryptocurrency exchanges. Gaining listings on major exchanges could have potentially restored some investor confidence and increased the token’s marketability. However, the process of securing such listings is complex and often requires overcoming regulatory and operational hurdles.

Reevaluating the Roadmap

The project team also revisited the initial roadmap, making adjustments to reflect more achievable goals and timelines. This reevaluation aimed to set more realistic expectations and demonstrate a commitment to delivering on their promises. However, the impact of these adjustments was limited given the extent of the damage to the project’s reputation.

Broader Implications for the Cryptocurrency Market

The rise and fall of Lucky Block is not an isolated incident in the cryptocurrency market. It reflects broader trends and challenges that many projects face, highlighting the need for greater scrutiny and more robust standards within the industry. Here are some broader implications:

The Importance of Regulatory Oversight

The cryptocurrency market is still relatively young and, in many jurisdictions, lacks comprehensive regulatory oversight. This regulatory gap can create opportunities for fraudulent or poorly managed projects to thrive temporarily. However, it also means that investors need to be particularly vigilant. Increased regulatory oversight could help protect investors and ensure that projects adhere to certain standards of transparency and accountability.

The Role of Exchanges

Cryptocurrency exchanges play a crucial role in the ecosystem, not only as platforms for trading but also as gatekeepers that can help vet projects. Major exchanges typically conduct thorough due diligence before listing new tokens, which can provide an added layer of security for investors. Projects that are only listed on obscure or less reputable exchanges may pose higher risks.

Community and Investor Education

The importance of education cannot be overstated in the cryptocurrency market. Investors need to be equipped with the knowledge and tools to conduct thorough research and make informed decisions. Educational initiatives and resources provided by reputable sources can help investors navigate the complex and often risky landscape of cryptocurrency investing.

A Cautionary Tale

The saga of Lucky Block serves as a cautionary tale for cryptocurrency investors. While the project presented an innovative concept and initially captured significant interest, the red flags that emerged highlight the importance of thorough research and cautious investing. The lack of transparency, unrealistic gains, limited exchange listings, and negative community sentiment all contributed to the project’s decline.

As the cryptocurrency market continues to evolve, it is essential for investors to prioritize responsible investing practices. Conducting thorough due diligence, focusing on projects with clear and detailed roadmaps, and avoiding the pitfalls of hype-driven investments can help navigate the exciting but often risky world of cryptocurrency. By learning from the lessons of projects like Lucky Block, investors can make more informed decisions and contribute to a healthier and more sustainable crypto ecosystem.

The story of Lucky Block is a cautionary tale that underscores the importance of due diligence, transparency, and responsible investing in the cryptocurrency market. While the project presented an innovative concept and initially captivated significant interest, the lack of detailed information, unrealistic promises, and emerging red flags led to its decline.

For investors, the key takeaways from Lucky Block’s rise and fall include the necessity of conducting thorough research, being wary of hype-driven investments, and prioritizing projects with transparent and trustworthy teams. By adhering to these principles, investors can better navigate the volatile and exciting world of cryptocurrency and make more informed decisions.

As the cryptocurrency market continues to evolve, it is crucial for both investors and project developers to learn from the lessons of past projects like Lucky Block. Responsible investing, combined with increased regulatory oversight and robust community standards, can help build a more sustainable and trustworthy cryptocurrency ecosystem.

Final Thoughts: Moving Forward

Despite the setbacks and challenges highlighted by the Lucky Block case, the potential for blockchain technology and decentralized systems remains significant. Innovations in this space continue to offer opportunities for creating more transparent, efficient, and equitable solutions across various industries. For project developers, the lessons from Lucky Block emphasize the importance of transparency, realistic goal-setting, and community engagement. Providing detailed and accurate information, setting achievable milestones, and actively engaging with the community can help build trust and credibility.

For investors, the experience with Lucky Block serves as a reminder to approach the cryptocurrency market with caution and skepticism. By conducting thorough research, avoiding hype, and investing responsibly, investors can protect themselves from potential pitfalls and better position themselves to benefit from genuine innovations in the space.

As the cryptocurrency market matures, the combined efforts of responsible investors, diligent project developers, and effective regulatory frameworks can help foster a healthier and more sustainable ecosystem. While the journey may be fraught with challenges, the potential rewards of a well-functioning and transparent cryptocurrency market are well worth the effort.

Related Content

- Unlocking the Ledger: Cryptocurrency Basics

- Decoding the Future: Navigating the Crossroads of Cryptocurrencies and Artificial Intelligence

- Unveiling Crypto’s Wild Ride: Navigating Risks and Regulatory Roads Ahead

- Revolutionizing Crypto: How AI Catalyzes Innovation

- BlackRock’s RWA Crypto Dive: A Conservative Look at 2025prehensive Literature Review

- What Is a Lucky Block? Is It a Scam? DYOR and Opinions | by Cryptonica Editorial

- How can people not see Lucky Block is a scam? : r/LuckyBlock

- What Is a Lucky Block and Is It a Scam? Reviews, Opinions, and DYOR

- Is Lucky Block (v1) a scam? Or is Lucky Block (v1) legit?