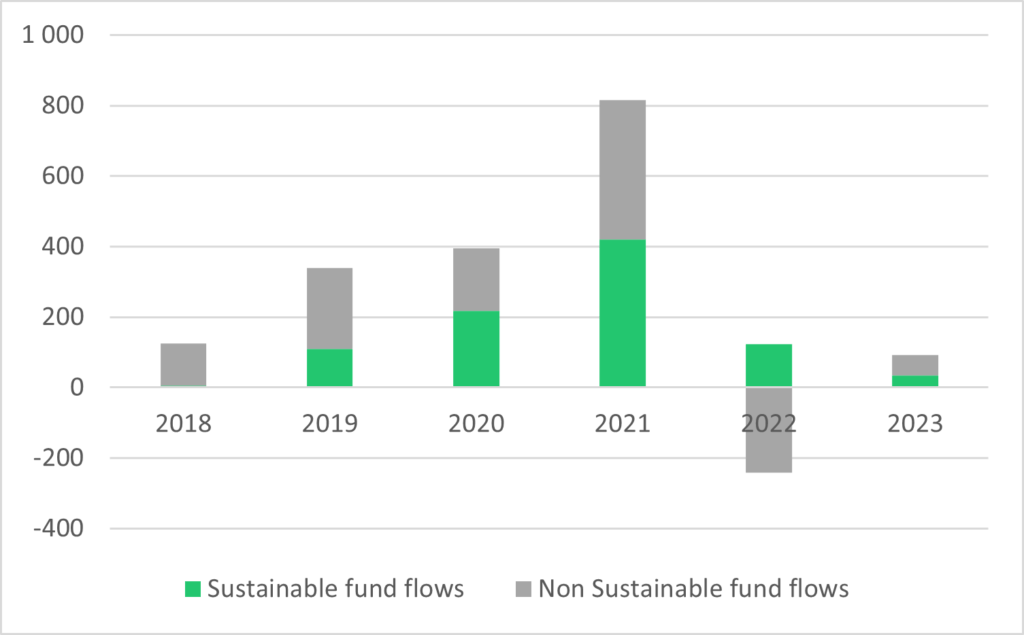

Sustainable finance is facing an unexpected downturn, with ESG (Environmental, Social, Governance) funds experiencing a sharp decline in 2024. After years of rapid growth, the number of new ESG fund launches dropped by 50% in the first half of the year. This decline is driven by market normalization, regulatory uncertainty, and greenwashing scandals, particularly affecting the U.S. market. However, Europe remains resilient, with French giants Amundi and BNP Paribas Asset Management leading new fund launches. To ensure sustainable growth in ESG investing, investors should focus on diversification, transparency, and innovation.